The billing to the customers. Bad Debt Direct Write-Off Method.

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Allowance For Doubtful Accounts.

. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Under the direct write-off method bad debt expense serves as a direct loss from uncollectibles which ultimately goes against revenues lowering your. Notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off.

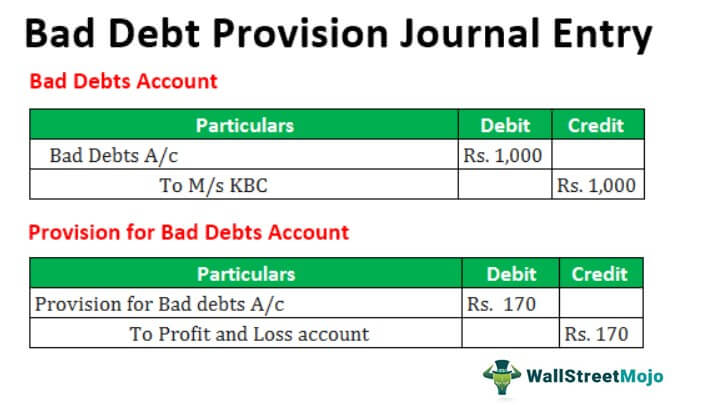

2 Next the Company needs to initiate the following entry to write off the bad debt of customer A. Bangkok governor Chadchart Sittipunt and Miss Universe Thailand 2022 Anna Sueangam-iam kicked off a pilot project to separate recyclable garbage on Sunday. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name.

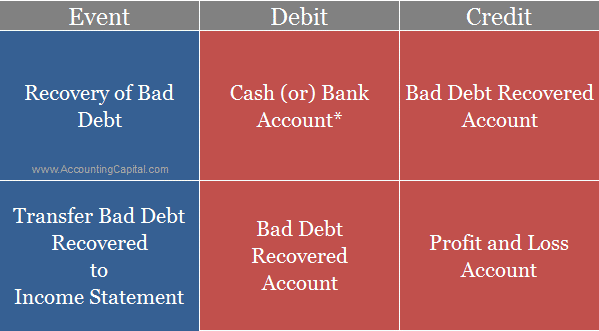

In either case the company will recognize it as income for the business. After moving to Kalispell Montana they settled in Helena in 1913. The journal entry to record the bad debt recovered is debit cash and credit other income.

A provision for. Trade Debtor Accounts Balance Sheet 2000. The recovery of a bad debt like the write-off of a bad debt affects only balance sheet accounts.

70000 written-off as a bad debt being transferred to bad debts. This recovered amount may be a partial payment received against the total of the written-off amount or it may be a lower amount agreed with the company for the total written-off amount. An accounting entry made into a subsidiary ledger called the General journal to account for a periods changes omissions or other financial data required to be reported in the books but not usually posted to the journals used for typical period transactions the cash receipts journal cash disbursements journal the payroll journal sales.

Doubtful Debts 2300 Inventories Machinery Furniture Building Goodwill 117300 35700 134000 100000 180000 570000 63000 1200000 1200000 On 31st March 2021 Gini retired from the firm. 80000 and it is doubtful that the customer may not pay the sum. It is not directly affected by the journal entry write-off.

Suppose the amount due from a customer is Rs. When you assign us your assignment we select the most qualified. In all the Greek economy suffered the longest.

Explanation of Provision for Bad Debts. Miss Universe Thailand kicks off Bangkok trash separation scheme. A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year.

The Marshalsea 13731842 was a notorious prison in Southwark just south of the River ThamesAlthough it housed a variety of prisoners including men accused of crimes at sea and political figures charged with sedition it became known in particular for its incarceration of the poorest of Londons debtors. Debits and credits occur simultaneously in every financial transaction in double-entry bookkeeping. Below are the examples of provisions for a bad debt journal entry.

The following journal entry is made for this purpose. The two methods of recording bad debt are 1 direct write-off method and 2 allowance method. Sep 04 2022.

Hubbards father rejoined the Navy in April 1917 during World War I while his mother worked as a clerk for the. Ron Hubbard was born in 1911 in Tilden Nebraska the only child of Ledora May née Waterbury who had trained as a teacher and Harry Ross Hubbard a former United States Navy officer. The increase was driven by increased expected losses in its US mortgage portfolio.

Bentley stolen from London recovered from military house in Pakistan. Not all debtors pay their dues every time. I Bad debts amounted to 5000.

All our writers are graduates and professors from most of the largest universities in the world. So the firm does not want to write off the sum for the time being. In the next financial year the debt becomes bad debt which needs to be written off.

Bad debt expense represents the amount of uncollectible accounts receivable that occurs in a given period. See uncollectible accounts expense allowance method. Otherwise a business will carry an inordinately high accounts receivable balance.

When a written off account is recovered the first step is to reinstate it in the accounting record. A bad debt can be written off using either the direct write off method or the provision method. Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 20072008Widely known in the country as The Crisis Greek.

In the accounting equation Assets Liabilities Equity so if an asset account increases a debit left then either another asset account must decrease a credit right or a liability or equity account must increase a credit rightIn the extended equation revenues. While posting the journal entry for recovery of bad debts it is important to note that it is treated as a gain to the business that the debtor should not be credited as in. The first approach tends to delay recognition of the bad debt expenseIt is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible.

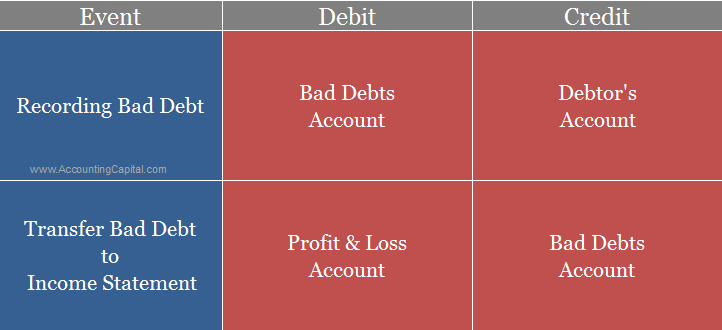

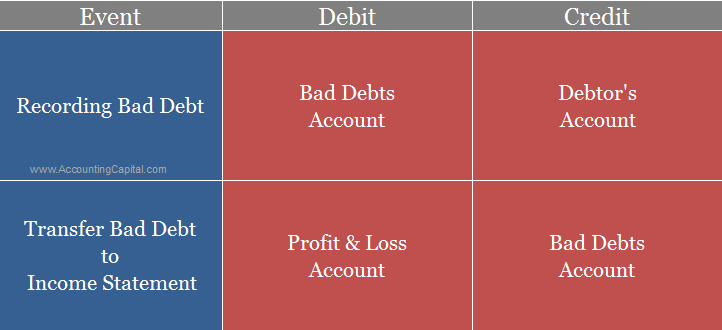

Bad Debts Written Off Income Statement 2000. Journal Entry for Bad Debts. Partially or fully irrecoverable debts are called bad debts.

Bad debts provision Bad Debts Provision A bad debt provision refers to the reserve made by a company to set aside an amount computed as a specific percentage of overall doubtful or bad debts that has to be written off in the next year. This was the first major subprime related loss to be reported. Bad debt is debt that is not collectible and therefore worthless to the creditor.

Over half the population of Englands prisoners in the 18th century. When a customer pays after the account has been written off two entries are required. It is simply a loss because it is charged to the profit loss account of the company in the name of provision.

Bad debt is usually a product of the debtor going into bankruptcy but may also occur when the creditors cost of. At times a debtor whose account had earlier been written off by a creditor as a bad debt may decide to make a payment this is called the recovery of bad debts. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

The crisis began to affect the financial sector in February 2007 when HSBC one of the worlds largest banks said its charge for bad debts would be 105 billion 20 higher than expectations. All the partners agreed to revalue the assets and liabilities on the following basis. These papers are also written according to your lecturers instructions and thus minimizing any chances of plagiarism.

However we need to understand that bad debt write off is not consistent with the Matching concept. The method involves a direct write-off to the receivables account. 1 Direct Write-Off Method.

The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. Read more is recorded as a direct loss from defaulters writing off their. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss.

Η Κρίση it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property as well as a small-scale humanitarian crisis. Journal Entry for Recovery of Bad Debts. The Bad Debts Expense remains at 10000.

An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the accounts receivable expected to be. Bad debt expense occurs as a result of a customer being unable to fulfill its obligation. 1 The entry made in writing off the account is reversed to reinstate the customers account 2 The collection is journalized in the usual manner.

We have highly qualified writers from all over the world.

What Is The Journal Entry For Bad Debts Accounting Capital

0 Comments